How I Saved a Thousand Dollars a Year on My Subscriptions

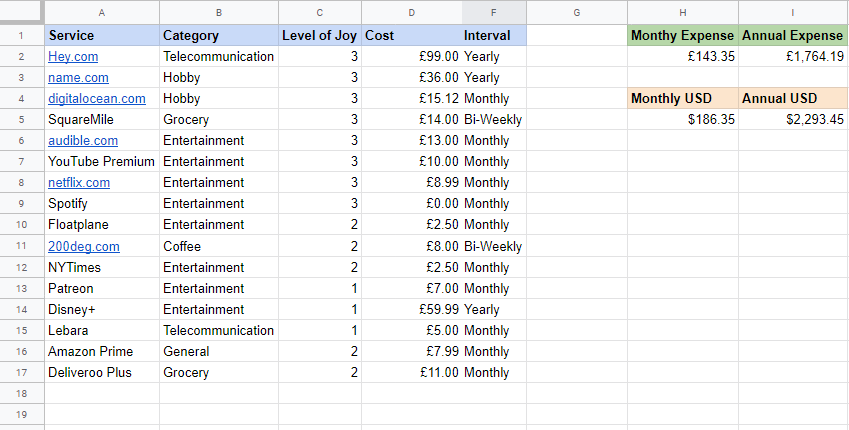

Three months ago I had 18 monthly/annual subscriptions totaling over $186.36 a month. Mind you, these are all non-essential subscriptions. These aren’t things like electricity, gas, heating, water, etc.

That is over $2000 a year on things I don’t need.

After totaling these numbers up it made me realize that I was spending money on so many different things I didn’t even know what I was paying for on a regular basis anymore and had lost context and wasn’t counting the cost.

I don’t even have time to use all these things, so I wasn’t getting a good ROI.

How to Calculate How Much You’re Spending on Subscriptions

I downloaded my monthly statements from the past three months and combed through them to see what categorizes as a subscription.

This took a few hours, but I found the manual review process to be the most effective way of taking stock of these things.

Rank Subscriptions By Level of Joy

I’m taking a bit of a Marie Kondo principle here. I recommend using a 1-3 rating. 1 being little joy, 2 being moderate joy, 3 being immense joy.

This is a subjective process so I had to be critical and honest with myself for it to be useful.

For example, I like Disney+. But when I checked to see how often I actually logged into Disney+, I wasn’t actually getting much recurring joy from it. I had only logged in twice in the four months I had the service.

So for me, Disney+ counted as a level 1. I enjoyed the time I spent on it, but not frequently and not for long. In my world that makes it a 1.

I put Spotify as a 3. I love music and listen to music regularly while I work or hang out by myself at home. It brings me joy every day and makes my life better.

Get my free Google sheets template for subscription analysis.

Analyzing My List of Subscriptions

This is what my list looked like after I reviewed everything and gave everything a ‘level of joy’ rating.

Again, you can see the total monthly and annual cost in columns H and I. Mind blowing, at least to me.

So everything that I ranked as a 1 and 2, I cancelled. Easy as that. In the realm of subscriptions I only want to keep things around that bring me immense joy.

That brought my total and list down to $112.27 a month. That is a savings of $74.08 a month.

We’re making progress, but there is another question we can ask ourselves.

Cancelling Services that Encourage Spending More

Two ‘savings cards’ or discount memberships I was using were also bloating my month spending: Amazon Prime and Deliveroo Plus.

Both programs incentivize you to spend more to “get your money’s worth”.

Cancelling Amazon Prime

Amazon Prime customers spend more than twice the average non-Prime member. I know that I fell into that average, and here’s how:

I downloaded my credit card statements for the past six months. Three months prior to cancelling my Prime membership I spent £1031.07. Three months after cancelling I spent £442.10.

It’s so easy to just add a few things here or there to your cart and it’ll be there in a day or two. Easier than going to the store, right? Right. That’s the point.

It removes friction from the purchase process which makes us less likely to question the decision. Sometimes friction is a feature. I still retain the same amount of joy, as the things I do end up buying still bring me joy. I just buy fewer things on a whim.

Cancelling Deliveroo Plus

The same holds true for Deliveroo. I still order through Deliveroo from time to time. But on average I order 50% less than I did in my three-month analysis, which amounts to a monthly savings of around £50.

Now I may spend some of that money on purchasing more groceries. But I’d rather invest that money into eating healthy and learning how to cook, both bring me more joy than high-calorie, lazy delivery meals…in the long run at least.

Can You Downgrade a Service and Still Be Happy?

Let’s take a look at two key examples from my own personal list.

I was using Netflix’s HD plan, but when I thought about it I normally watch most Netflix shows in picture and picture mode on my computer and have it on as background noise while I play a game. So for me, the SD plan will do just fine and bring me the same amount of joy. This saves me $3.90 a month.

My Audible subscription was at the two credits a month plan, but I often have extra credits that carry over so I don’t need two credits every month. One will suffice. So I downgraded that and saved $8 a month.

I have a coffee subscription plan from Square Mile Coffee in London. I absolutely love their freshly roasted coffee. But if I pace myself a bit more, which I should do for health reasons, I can cut back my bi-weekly coffee subscription to a monthly subscription. This saves me $18.20 a month.

So just by asking myself if I really need everything that a service offers me to be happy and deciding where I can adjust and still maintain my level of joy I saved $31.10 a month.

How Much Did I Save?

After all the chopping and changing I was able to save $1262.16 a year. That is a month of rent or a few car payments.

If I were to invest that money and get 7% annual compound interest I could turn that into $17,436.36 over 10 years. That’s a nice used car or part of a downpayment on a house.

That isn’t including what I saved just by spending 50% less on Amazon and Deliveroo. Including those amounts would bring me to around $450 a month in savings.

I’d love to hear how much you’re saving by applying this or your own Kondo-like process. Let me know on Twitter if you used this method with any success.